owe state taxes how to pay

Click the Print Federal Return or Print State Return on the My Account screen. Pay the full amount due online via INTIME prior to tax deadline.

How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

If you owe taxes the IRS offers several options where you can pay immediately or arrange to pay in installments.

. June 7 2019 357 PM. The best way to figure out if you owe taxes is to complete your tax forms completely. The state of Arkansas charges 1 per month on taxes that are not paid by the deadline.

Pay including payment options collections withholding and if you cant pay. The department may offset any money owed to you from a state or federal tax refund to either shorten the duration of your IPA or pay your balance in full. A short-term payment plan to pay within 11-120 days.

Owe state taxes how to pay. If you owe state tax there is a payment voucher in your state tax return that contains instructions on how to submit your state tax payment. You will also report how much of your state tax.

Interest of 10 per year on any additional tax due from original due date to date. The state of Arkansas charges 1 per month on taxes that are not paid by the deadline. An installment agreement to pay the balance due in monthly.

You can print out the payment voucher from within the account. Send an estimated tax payment or. Pay As Quickly As Possible.

To find out how much you owe. You will enter your income deductions and credits. The IRS must receive Form 4868 on or before the tax filing deadline which is usually April 15 unless that day falls on a weekend or holiday.

Pay using your bank account. If you cant pay your state tax bill or you receive a notice. You can pay or schedule a payment for any.

The amount of state and local income tax you pay will depend on how much income you earn and the tax rate of the state or locality where you live. An agreement to pay within the next ten days. Log in to your account.

To report non-filers please email. Taxpayers may pay their tax by using a creditdebit card VisaMasterCard or bank draft via our online payment system or by contacting an agent at 1-877-252-3252. A PDF of your accepted.

If you have taxes owed in the File section of the program you are given options on how you want to pay. If you owe taxes to your state the best thing to do is pay them in full when you file your return. You can pay by check or money order with a.

This secure online application allows you to pay by either debit card ACH credit. You filed tax return. Arkansas Online Tax Payment.

The best option is to pay the entire amount due via INTIME DORs new e-services portal at. What you may owe. Pay personal income tax owed with your return.

It would be the next business day in this. Interest of 10 per year on any additional tax. This isnt always possible however.

You received a letter. Pay income tax through Online Services regardless of how you file your return. Please call 251 344-4737.

If you owe tax that may be subject to penalties and interest dont wait until the filing deadline to file your return. The calculation of after-tax income is. As an alternative after-tax income can be calculated on a yearly basis or on a pay-as-you-go basis such as when paychecks are paid out.

To pay your taxes electronically you can do so at the New York State Department of Taxation.

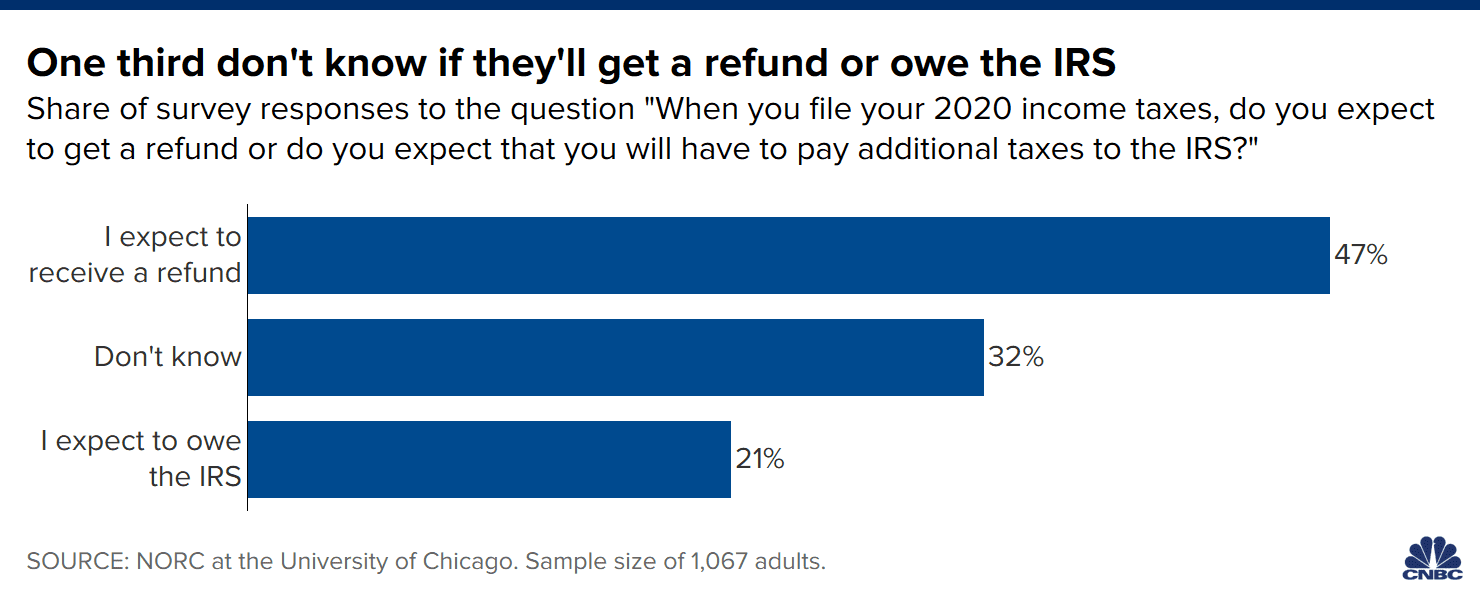

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

What Do You Do If You Owe State Taxes And Can T Pay Quora

47 Of Households Owe No Tax And Their Ranks Are Growing Sep 30 2009

Franchise Tax Board Homepage Ftb Ca Gov

Irs Finds Growing Gap In Income Taxes Owed Taxes Paid Newsmax Com

1040 2021 Internal Revenue Service

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

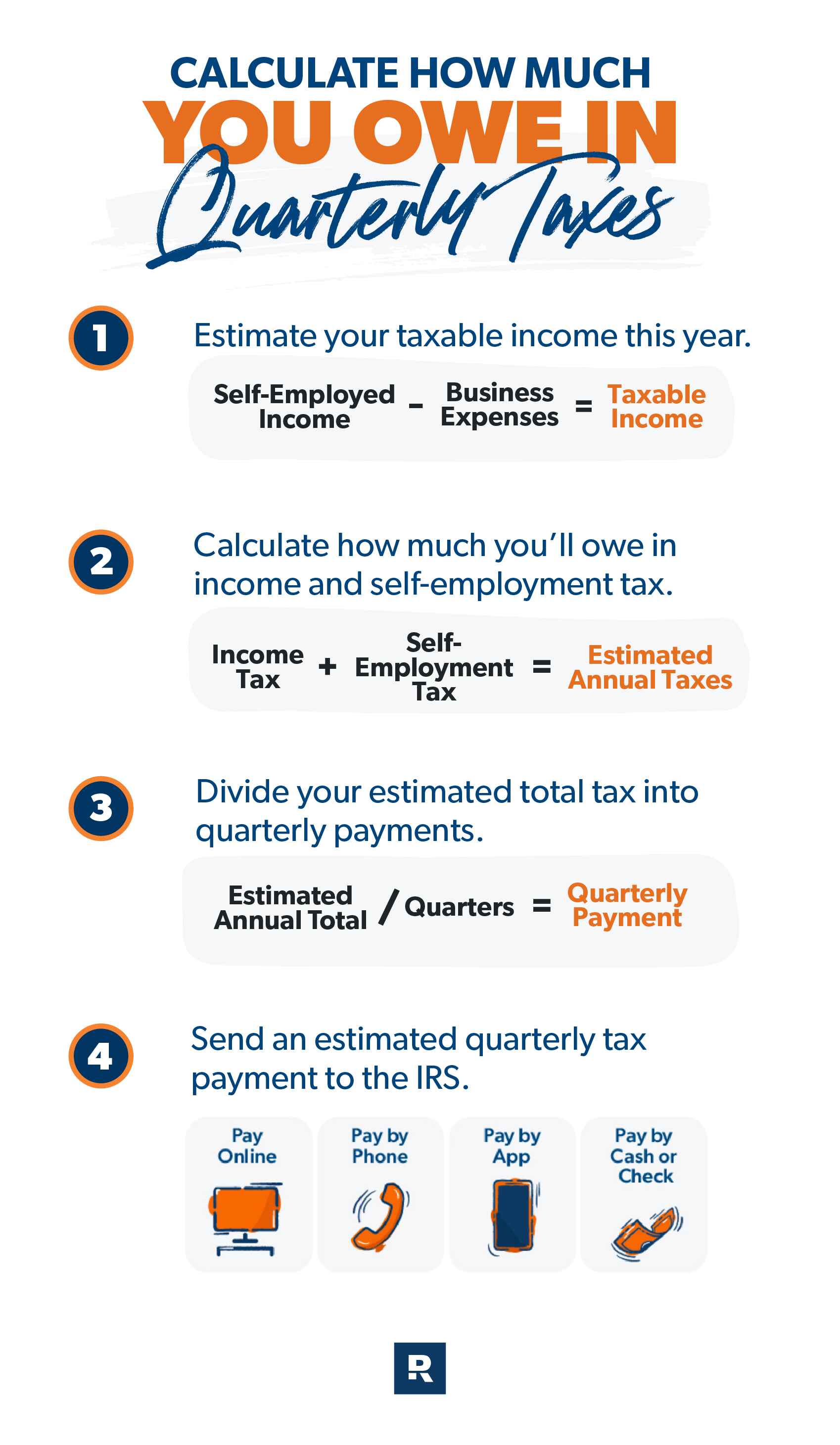

What Are Quarterly Taxes Ramsey

Types Of Taxes The 3 Basic Tax Types Tax Foundation

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

Form 1040 V Payment Voucher Definition

New Tax Law Take Home Pay Calculator For 75 000 Salary

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)